The Evolution of TAMPs: From RIAs to IBDs and Back Again

TAMP & Technology • Written by: Brendan Falls, CFP®

The Currents of Change

When Turnkey Asset Management Platforms (TAMPs) first emerged over 30 years ago, they may have been technologically rudimentary, but they were revolutionary at the same time. Their ascendance coincided with major structural changes in wealth management and they benefitted from the resulting tailwinds. In droves, advisors were moving away from commission-based products and traditional wirehouses. A new wave of independence prioritizing fee-based service, model portfolios, and financial planning swept the advisory landscape and Registered Investment Advisors (RIAs) as well as Independent Broker Dealers (IBDs) benefited from the movement.

|

Whitepaper written by: |

The first generation of TAMPs were a timely solution for the newly independent fee-based advisors, yet they were rigid in structure. Early TAMPs controlled the direct relationship with the custodian, oftentimes resulting in inefficient communication and clunky custodial service for the end-user advisors and their clients. Early adopters also had to deal with an aspect of giving up control to the TAMP. In those days, the TAMP would act in a primary advisor capacity to the end clients, meaning it had just as many compliance obligations to the client as the advisor did. Those factors, in addition to the very narrow scope of investment solutions available, would seem very unfamiliar and inflexible to contemporary TAMP users in the RIA market today.

The Evergreen Pastures of Independent Broker Dealers

The RIA market of the early 1990’s was not what it is today. It was emerging, but it just wasn’t big enough or diverse enough. TAMPs needed to tap a different channel to fuel their growth. IBDs quickly proved to be good incubators, as they were well-suited to adopt the TAMP structure and services. A selling agreement with a TAMP allowed a IBD Home Office to offer its representatives the services and variety of a TAMP without having to build that infrastructure themselves. IBDs were able to increase their revenue by up-charging their advisors and clients, while the TAMPs were able to rapidly scale their businesses on the backs of thousands of Investment Advisor Representatives. While this arrangement was a great deal for IBDs and TAMPs, it was less than ideal for advisors. Model portfolios were extremely expensive due to the layering of fees and “take it or leave it” approach. Additionally, advisors had to deal with the rigid confines of the IBD compliance protocols and the associated low degree of choice and flexibility in the TAMP offering. Ultimately, advisors in this structure lacked total control over their practice management processes, investment management offering, and even their end client relationships.

The RIA market of the early 1990’s was not what it is today. It was emerging, but it just wasn’t big enough or diverse enough. TAMPs needed to tap a different channel to fuel their growth. IBDs quickly proved to be good incubators, as they were well-suited to adopt the TAMP structure and services. A selling agreement with a TAMP allowed a IBD Home Office to offer its representatives the services and variety of a TAMP without having to build that infrastructure themselves. IBDs were able to increase their revenue by up-charging their advisors and clients, while the TAMPs were able to rapidly scale their businesses on the backs of thousands of Investment Advisor Representatives. While this arrangement was a great deal for IBDs and TAMPs, it was less than ideal for advisors. Model portfolios were extremely expensive due to the layering of fees and “take it or leave it” approach. Additionally, advisors had to deal with the rigid confines of the IBD compliance protocols and the associated low degree of choice and flexibility in the TAMP offering. Ultimately, advisors in this structure lacked total control over their practice management processes, investment management offering, and even their end client relationships.

Winds (or Hurricanes!) of Change

Over the last ten years, the RIA market has exploded. Advisors and teams were now breaking away from IBDs in addition to traditional wirehouses. Many factors caused this surge. For one, commission revenues became less relevant to advisors as they continued to move towards fee-based service. Perhaps more significantly, advisors desired more control and flexibility. Advisors did not want to be micromanaged by the IBD home office, and they did not want any other entities having relationships with their clients. Advisors desired complete control of their destiny and RIAs were the way forward. As far as the legacy TAMPs, they were part of the confining structure advisors were trying to leave. The TAMPs were a mechanism for “control” over the advisor. The TAMPs were not working for the advisor, they were serving the IBD Home Office the advisor was leaving.

An important question emerged: Whether the TAMP could retain advisors after they left the IBD? Unfortunately for the legacy TAMPs, the answer to this has proven largely to be, “no.”

Meet Them Where They Are, Not Where You Want Them To Be

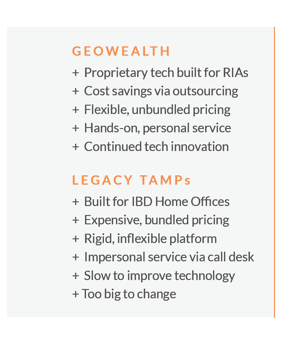

The current RIA market looks nothing like the market the original TAMPs built their businesses on. RIAs are incredibly price conscious as they know they have a plethora of choices and services at their disposal. They desire flexibility in a way that would have been inconceivable in the IBD structure. RIAs want complete control over their relationship with the custodian and they demand to interact with vendors on their terms - TAMPs included. RIAs are accustomed to and demand vendor solutions that are built for them, not the IBD Home Office from years past. The service requirement of serving RIAs is high touch. Personal relationships are desired, and frankly, mandatory. Unfortunately for the oldest and largest incumbent TAMPS, it has become abundantly clear that that they struggle to effectively serve the RIA market. But high profit margins are hard to give up in the captive IBD world. What TAMP model can truly deliver an RIA-catered solution

GeoWealth, The Advisor’s TAMP

GeoWealth, The Advisor’s TAMP

A new, advisor-centric TAMP model has emerged to serve today’s dynamic RIA market. Offering proprietary, integrated technology with high-touch service, GeoWealth was built specifically to serve RIAs. Recognizing that RIAs need a trusted partner to help them outsource operational components of their practice like trading, billing, and performance reporting, GeoWealth strives to provide those services on the advisor’s terms. The advisor has complete control and drives the ship, while GeoWealth supports the advisor as an extension of their back office. Because GeoWealth developed and operates its own technology, it is able to offer lower pricing as it does not have to pay licensing fees to other providers. GeoWealth recognizes that TAMPs have a legacy. Historically they were known for being inflexible, controlling, expensive, and with poor customer service. Those TAMPs were built for IBDs. GeoWealth is the TAMP for RIAs, providing them the pricing, service, and flexibility they deserve.

Brendan Falls is the SVP, Strategic Growth at GeoWealth, an enterprise technology and TAMP built for the needs of the modern RIA.